“The nation that dominates clean technology will undoubtedly lead in the energy systems of the future.”1

This quote by Danfoss North America President Rick Sporrer highlights the importance of the energy transformation. Ambitions to tackle this monumental task are great, and so are the commitments.

But what about concrete results?

Clean tech, green tech, climate tech—no matter what you call them, decarbonization technologies are key to reducing greenhouse gas emissions.

Where do we stand in transforming our industries and economies?

The Paris Agreement was signed nine years ago, and we are already halfway into what has often been called a “decisive decade.”2 Let’s see how climate tech has been evolving in Europe and the US (other regions will be covered in future articles). For this overview, I will heavily draw on a recent McKinsey analysis.3

So, what’s the expert verdict?

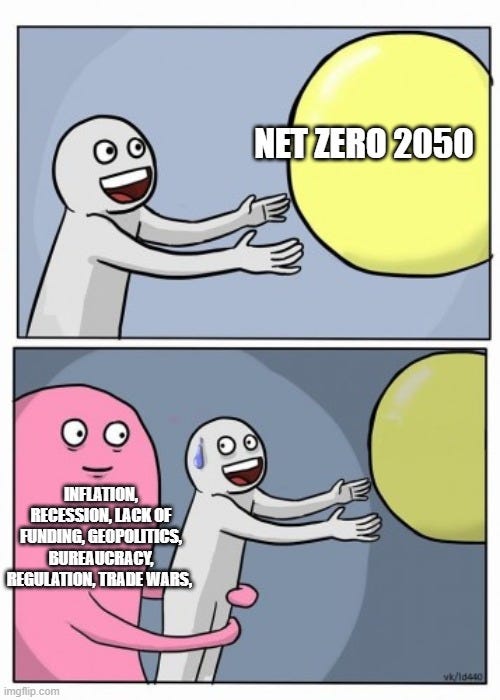

They found a gap between ambitions and achievements.

Globally, only around 10% of the sustainable technology needed to meet the 2050 goals has been deployed, mostly in less challenging areas.4

Let’s explore why. But, as my teacher used to say after my presentations, let’s start with the positives.

Ambitions and Commitment

Increasing public pressure to act on global warming led to the Paris Agreement in 2015. 195 countries signed the agreement, committing to NDCs (nationally determined contributions) or climate action plans. More than 70 countries have set net-zero targets in law or policy documents.5

Climate Tech now lies at the center of industrial policies in many OECD countries:

The EU’s Green Deal aims for climate neutrality by 2050, while the Fit for 55 initiative targets a 55% emissions reduction compared to 1990 by 2030. The US has enacted the Inflation Reduction Act (IRA), which allocates historic funding for climate tech and decarbonization.

Globally, between 2010 and 2023, renewable energy capacity grew around 20% per year. Also, 66% of Fortune 500 companies (why not all?!?) have made climate commitments, and more than 5,000 companies worldwide adhere to the Science Based Targets initiative—the widely accepted gold standard for voluntary climate goals.6

However, balancing energy security, affordability, reliability, and industrial competitiveness alongside sustainability is a formidable challenge. Securing investment is tough for climate tech companies.7

A Gap Between Ambitions and Actions

Only a small number of decarbonization projects actually reach the final investment decision (FID) stage, where they receive the green light.8

For example, over 1,000 green or blue hydrogen projects have emerged in the US since 2015, but less than 15% have reached the FID stage. This trend is seen across most critical decarbonization technologies.9

In other words, there has obviously been a lot of progress, but not nearly enough.

Let’s look at EVs:

In Europe, there are about 11 million EVs on the road. To meet the EU’s goal of 30 million EVs by 2030, another 20 million must be introduced within five years!

In the US, only 5 million EVs are on the road, yet the goal is to have 26 million by 2030.10

EVs and also heat pumps have seen a sales lag in both Europe and the US. Growth has slowed at a time when acceleration is urgently needed.

What about solar and wind?

While solar power in Europe has grown significantly in recent years, it’s not yet on track to meet the 2030 target of 600 GW. As of now, 390 GW is projected to be operational by 2030. Wind energy projects, on the other hand, vary depending on technology and geography. Wind projects typically take longer to complete, adding more uncertainty.11

Clean Tech Investments: It’s complicated

According to Bloomberg, renewable energy companies filing for bankruptcy has reached the highest level since 2014.12

Clean tech usually requires large sums of investment. These technologies have high initial costs and long development periods. Rising interest rates and inflation have worsened the situation. Historically, decarbonization tech has a high failure rate, making it more vulnerable to external shocks.

There’s also a “missing middle” in private fundraising. Early funding for clean tech startups isn’t usually a problem, but scaling capital is hard to secure. This is especially challenging for companies with high “burn rates” and no clear path to profitability.13

Another issue: struggling green tech companies generate bad publicity. Bankruptcies could erode public trust in the energy transition, especially with domestic politics becoming increasingly polarized.14

In Europe, a report titled “The Future of European Competitiveness” by former ECB president Mario Draghi confirms many of the McKinsey findings. It highlights Europe’s potential in clean tech, some of which, according to Mr Draghi, has been squandered.15 Globally, over 20% of clean technology is still developed in the EU. Yet since 2020, patenting in low-carbon innovation has slowed down.16

Reasons for the Gap

We can explain the gap between ambitions and results with three major themes.17

1. Weak business cases: Economic returns and policy predictability are often lacking.

2. Cost-competitiveness: Many technologies aren’t cost-competitive yet, often because at-scale manufacturing is not yet possible.

3. Scaling: Many technologies haven’t been tested at scale, creating uncertainty among investors.

In short, many projects are still at risk of cancellation.

The McKinsey analysts have identified several major roadblocks to investment:18

Grid reform challenges

A tough macroeconomic environment: rising inflation and interest rates

A volatile investment climate post-pandemic

Overly long and complex permitting processes

Fluctuations in carbon pricing

Raw material shortages

Geopolitical uncertainty and supply chain disruptions

Missing technological and business case maturity

Specialized labor shortages

Businesses themselves cite complex regulations and permitting processes as major barriers to decarbonization technology development in Europe.19

There are also the hard-to-decarbonize sectors where CCUS, hydrogen, and sustainable fuels will play key roles. For the most part, these technologies have yet to be proven to work at scale, and entire value chains must be built around them.20

Outlook

“The continent is in the midst of a competitiveness crisis.”21

In Europe, a struggling clean tech sector reflects a broader decline in competitiveness. Around 2000, 41 of the world’s 100 most valuable companies were based in Europe. That number has since fallen to 15.22 Mr Draghi and business groups, like the German BDI, are calling for a massive increase in investment to help Europe catch up with the US and China.

China’s growing dominance in Green Tech deserves its own article. By 2028, China will account for about 60% of global renewable energy capacity. According to the Australian Strategic Policy Institute, China leads in 37 out of 44 critical technologies across all sectors.23

In any case, we should not ignore the progress made, especially since the Paris Agreement. Overall, policy initiatives and corporate attitudes are moving in the right direction as public pressure grows.

Companies must ensure their sustainable business models do not rely too heavily on external funding. They should focus more on profitability and commercial viability when developing solutions.24 Forming industrial partnerships, actively addressing challenges, and shaping adequate policies will be key.

It’s time to speed things up and unlock the true potential of the green tech industry worldwide.

If you enjoyed this newsletter, please share it with others and spread the word.

See you next week!

PS: Got any feedback? Please leave a comment below. Cheers!

P.P.S: You can also find me on X, Facebook, Instagram, and Linkedin.

__________

Sources:

Ibid.

Ibid.

Ibid.

Ibid.

Ibid.

Ibid.

Ibid.

Ibid.

Ibid.